Are you tired of manually inputting credit card transactions into your accounting system? Do you wish there was a way to automate this process and save valuable time for more strategic tasks? Look no further! In this comprehensive guide, we'll show you how to reduce your credit card accounting workload by 95%, using tools like Revolut Business, Bexio, and the powerful automation capabilities of Accrio.

Need help with automation?

We can help you automate your accounting & business processes step by step, so you can focus on what matters most.

Prerequisites:

-

Revolut Business Account

- Don't have a Revolut Business Account yet? Support us by creating your Revolut Business Account using our affiliate link.

-

Smartphone Digital Card Wallet (Optional)

- Apple Wallet (or for Android users - Google Wallet)

-

Accrio Account

- Create a free account and get started at Accrio.com.

-

Bexio Account

- Ensure you have a Bexio account to seamlessly integrate with Revolut Business.

-

Settlement with Balance Tax Rate (Saldosteuersatz) (Optional)

- This ensures a simplified tax recording process.

1. How We Use Revolut Business

We leverage Revolut Business for the majority of our business expenses, streamlining our financial operations and enhancing efficiency. Here's a breakdown of our approach:

Revolut Virtual Cards

Each employee possesses multiple digital cards, easily accessible via Apple Wallet or Google Wallet, each serving a specific purpose.

Virtual Card 1 - Meal Expenses

- Used for business meetings and client meals.

- Accrio then can automatically assign all expenses from this card to the account

Meal expenses. - Settlement with balance tax rate eliminates the need to record tax rates manually.

Virtual Card 2 - Travel Expenses

- Dedicated to travel-related expenses and registered in transportation apps.

- Accrio automates the assignment of transactions to the account

Travel expenses. - No need to create rules for every single transaction or transportation company.

Virtual Card 3 - General Expenses

- Our primary card for subscriptions and miscellaneous expenses.

- During the first few month we've had to create some rules in Accrio. Nowadays around 80-90% of our transactions get the correct accounts and tax codes, such as import tax assigned automatically - since all the rules are already in place.

Virtual Card n - Project Cards

- Utilized for larger projects to easily track and manage all associated expenses.

Physical Cards

While we have physical cards, they are rarely used, as all cards, including physical ones, are accessible via digital wallets, eliminating the need for physical cards.

Why We Don't Use Revolut Expenses

Despite its appealing concept, Revolut Expenses wasn't a perfect fit for us. The process involved too many clicks and we ended up unlinking and relinking receipts to transactions a lot since the automatic linking didn't work well. We also had to manually assign tax rates to each transaction, which was time-consuming and inefficient. This doesn't mean that Revolut Expenses is a bad product, it just wasn't efficient enough for our needs. As soon as you have many employees and transactions, expense handling via Revolut might still be an attractive option, since you can delegate the expense handling to your employees.

2. Import Revolut Business Transactions into Bexio with Accrio

At the end of each month, we streamline our financial processes by exporting Revolut Business transactions and seamlessly importing them into Accrio. This fully automated process takes less than 5 minutes.

Steps to Follow:

-

Download CSV Transactions from Revolut Business

- Follow this guide for detailed instructions on downloading transactions from Revolut Business.

-

Log in to accrio and Create a New Import Channel

- For first-time setup

- Log in to accrio and connect accrio to your Bexio account.

- Setup a new import channel with this guide on creating a new Import channel in Accrio.

- And check the specifics for Revolut Business Transactions in this guide

- Otherwise simply click on the plus sign on an existing import channel and drop the file into the dropzone.

- For first-time setup

-

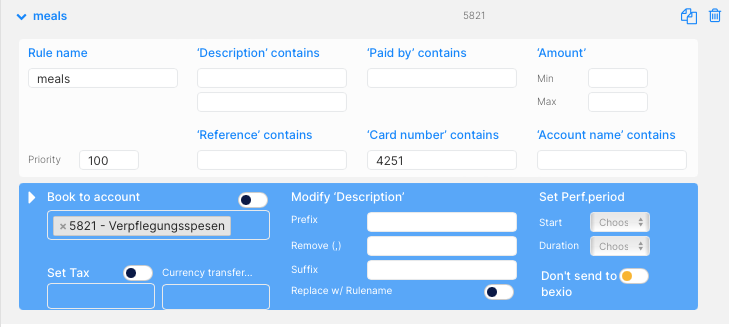

Configure Transaction Rules in Accrio

- For the meal cards: Create a rule that assigns all transactions to the account

Meal expenses.- We simply create one rule per card in accrio with the condition card number contains

1234(last four digits of the card number) which assigns all transactions from this card to the accountMeal expenses.

- We simply create one rule per card in accrio with the condition card number contains

- For the travel cards: Create a rule that assigns all transactions to the account

Travel expenses.- We simply create one rule per card in accrio with the condition card number contains

5678(last four digits of the card number) which assigns all transactions from this card to the accountTravel expenses.

- We simply create one rule per card in accrio with the condition card number contains

- For all other transactions: We create rules as described in this guide

- For the meal cards: Create a rule that assigns all transactions to the account

After that we can simply send the transactions to bexio and they will be assigned to the correct accounts and tax codes automatically.

By following these simple steps, you can automate the import of Revolut Business transactions into Bexio using Accrio. Enhance your financial workflows and save time for more strategic tasks! Embrace automation and simplify your financial processes today!

Need Further Assistance?

-

Take advantage of our complimentary setup service.

-

Explore tailored solutions for your business with our expertise in custom accounting automation. We've successfully optimized and automated accounting processes for numerous clients, enhancing their efficiency. Feel free to reach out to us for personalized guidance.

Did this blog post help you?

Support us by:

- Creating a Revolut Business Account using our affiliate link.

- Using our platform, Accrio, to automate your accounting.

- Buying us coffee ☕️.

- Sharing us with your network.